JAMMU: Commissioner, State Taxes Department (STD), P K Bhat, on today directed enforcement officers of GST to focus on real evasion of taxes, identify fake firm and constant monitoring of e-way bills for movement of goods.

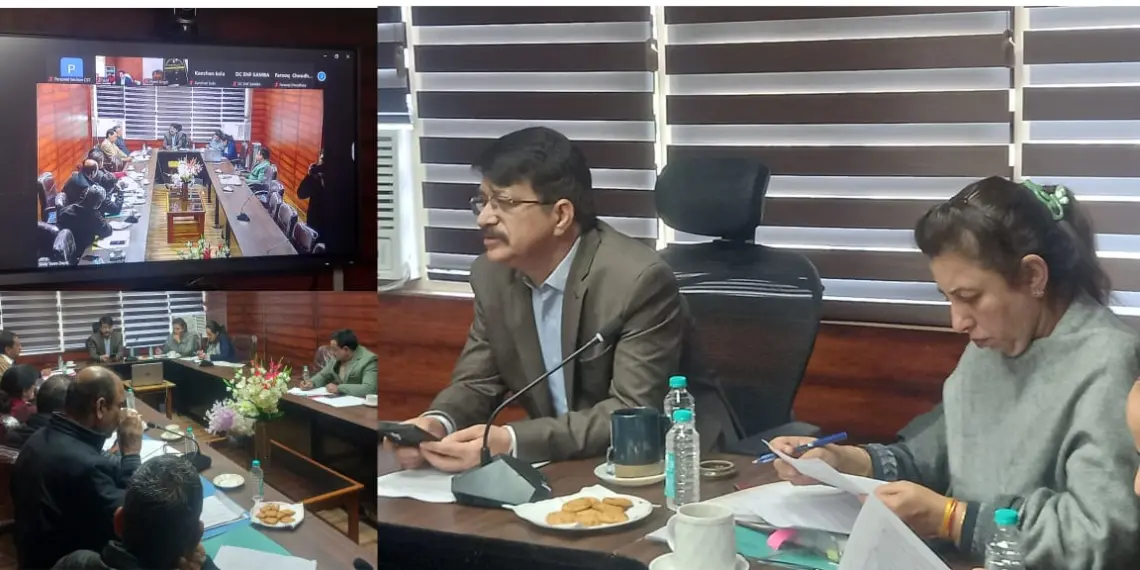

The Commissioner made these remarks while chairing a meeting to review the functioning of the department here today.

Additional Commissioner State Taxes Administration & Enforcement, Jammu, Namrita Dogra; Deputy Commissioners of Jammu Division attended the meeting while as all outstation DC’s attended meeting through virtual mode.

Addressing the officers, the Commissioner emphasized on the importance of finely balancing enforcement actions with the ease of doing business. Bhat called for enforcement teams to focus on identifying fake registrations, beneficiaries of fake input tax credit (ITC) and track-down fake e-waybills. He called for strict action against such entities to ensure that these steps create the necessary deterrence effect among the tax evaders.

The Commissioner also emphasized on the need for enforcement agencies to stay ahead of the evaders so that the sanctity of the GST system is preserved. He advised the enforcement officers to constitute special units for round the clock monitoring of different analytical tolls in the system and e-way bills from the backend. He asked them to flag any possible evasion case with concerned field unit for its interception.

The Commissioner also underscored that tax officials must be continuously connected with trade and business in the field reducing the need for intrusive enforcement action and enabling proactive compliance.

Commissioner STD directs GST enforcement officials to chase tax evasion, monitor e-way bills

A

A