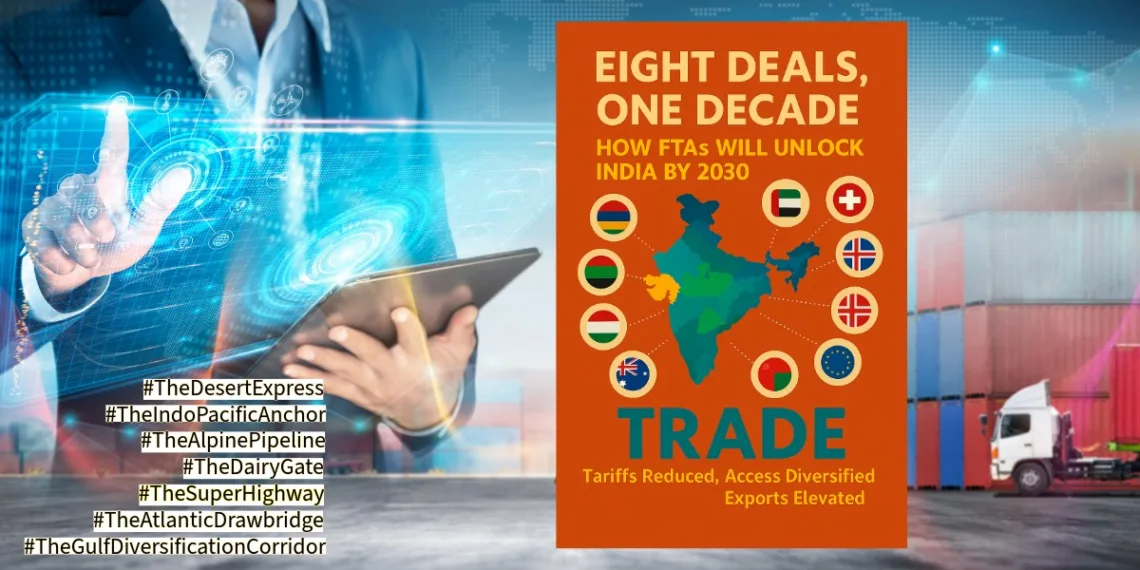

When nations sign Free Trade Agreements, they don’t dismantle toll booths overnight. Instead, they set clocks ticking- each tariff reduction scheduled like the chimes of a cathedral bell. Since 2021, India has signed eight FTAs, spanning Africa, the Gulf, Europe, and the Indo‑Pacific. These deals will redraw India’s trade map, reshape sectoral fortunes, but their toll booths vanish in phases. And if you listen closely, most of these bells will ring the loudest around 2030.

Mauritius CECPA, 2021 – The Lighthouse Bridge

(India’s first African FTA lit a beacon in the Indian Ocean)

Before India ventured into the larger trade highways of the Gulf and Europe, it first lit a beacon in the Indian Ocean. The CECPA with Mauritius was modest in scale but historic in intent; it marked India’s very first FTA with an African nation.

• Tariff Phasing:

a) Textiles & Apparel: 10–20% → 0% (2021).

b) Pharma: 5–15% → 0% (2023).

c) IT Services: phased till 2024.

Value: Covers 615 products; duty‑free access for 376 items.

Impact: Strengthened exports in textiles, pharmaceuticals, and IT services.

UAE CEPA, 2022 – The Desert Express

Before India built superhighways into Europe, it laid tracks across the desert sands. The CEPA with the UAE was signed in record time, becoming India’s fastest bridge to the Gulf and a gateway to $100 B + trade, making it India’s 3rd largest overall trading partner.

• Tariff Phasing:

a) Gems & Jewellery: 5% → 0% (2022).

b) Textiles & Leather: 10–15% → 0% (2023).

c) Food & Agriculture: 15–20% → 0% (2025).

d) Services: phased 2024–2026.

Value: Bilateral trade at $100B in FY25; target $200B by 2032.

Impact: Boosts gems & jewellery, textiles, agriculture, and logistics sectors.

Australia ECTA, 2022 – The Indo‑Pacific Anchor

As the Indo‑Pacific grew into a contested arena, India dropped anchor with Australia. The ECTA balanced China’s RCEP dominance and gave Indian exporters a sturdy foothold in the region.

• Tariff Phasing:

a) Agriculture & Textiles: 10–20% → 0% (2022).

b) Pharma & IT: 5–10% → 0% (2026).

c) Wine & Dairy Imports: 150%+ → 50–75% (2030).

Value: Target AUD 100B trade by 2030.

Impact: Expands textiles, agriculture, pharmaceuticals, and IT; dairy imports phased slowly.

EFTA, 2023 – The Alpine Pipeline

India’s bridge to Europe (Switzerland, Norway, Iceland, Liechtenstein) began not with tariffs but with capital. The EFTA deal promised a $100B investment pipeline, channelling funds from the Alps into India’s pharma, renewables, and technology sectors.

• Tariff Phasing:

a) Pharma & Chemicals: 5–10% → 0% (2025).

b) Renewables & Capital Goods: 10–15% → 0% (2030).

c) Services: tied to $100B investment, phased till 2038.

Value: $100B investment commitment over 15 years.

Impact: Strengthens pharmaceuticals, chemicals, renewable energy, and capital goods.

UK FTA, 2025 – The Atlantic Drawbridge

Across the Atlantic, India lowered a cautious drawbridge to post‑Brexit Britain. The UK FTA opened textiles and IT quickly, while autos and dairy crossed only in slow phases toward 2030.

• Tariff Phasing:

a) Textiles & Apparel: 10–12% → 0% (2025).

b) IT Services: liberalized immediately.

c) Automobiles: 60–100% → 30% (2028), 0% (2030).

d) Dairy: 40–60% → 20–30% (2030).

Value: Estimated £4.8B annual boost for UK by 2040; near‑complete tariff elimination.

Impact: Early gains in textiles and IT; delayed benefits in automobiles and dairy.

Oman FTA, 2025 – The Gulf Diversification Corridor

India’s Gulf story expanded beyond Dubai to Muscat. The Oman FTA diversified energy and industrial trade, building a corridor that strengthened India’s resilience in the region.

• Tariff Phasing:

a) Petrochemicals: 5–10% → 0% (2025).

b) Textiles: 10–15% → 0% (2027).

c) Industrial Goods: 15–20% → 0% (2028).

Value: India exported $4.06B to Oman in FY25; imports $6.5B.

Impact: Expand Petrochemicals, Textile, and Industrial goods.

New Zealand FTA, 2025 – The Dairy Gate

India opened a gate to New Zealand with caution. Education and agri‑tech flowed freely, but dairy tolls were dismantled slowly, protecting farmers until 2035.

• Tariff Phasing:

a) Dairy Imports: 60–100% → 0% (2035).

b) Education Services: liberalized immediately (2025).

c) Agri‑Tech: 10–15% → 0% (2027).

Value: Bilateral trade $2.4B (2024); $20B investment commitment over 15 years.

Impact: Opens education and agri‑tech; dairy phased cautiously.

EU FTA, 2026 – The Superhighway

Finally came the mother of all bridges-the EU FTA. A superhighway into a $16T economy, it promised quick lanes for pharma and IT, but long toll roads for autos and machinery stretching to 2035.

• Tariff Phasing:

a) Pharma & IT: 5–10% → 0% (2028).

b) Textiles: 10–12% → 0% (2028).

c) Automobiles & Machinery: 60–100% → 30% (2032), 0% (2035).

d) Procurement & Social Security: phased from 2030.

Value: India exported $136.5B to EU in FY25; pact covers 99% of exports.

Impact: Strengthens pharmaceuticals, IT, textiles; delayed gains in automobiles and machinery.

2030: India’s Turning Point for Exports and Investment

By 2030 India’s trade barriers will have largely fallen, enabling delayed sectors such as automobiles, dairy, and capital goods to finally scale alongside textiles, IT, and pharma. Expanded links across Africa, the Gulf, the Indo‑Pacific, and Europe will diversify markets and counterbalance regional trade blocs. The result: stronger export earnings, renewed FDI inflows, and a fresh leg for stock‑market growth.